CLINUVEL Investor Webinar Financial Results Year Ended 30 June 2021

| Melbourne, Australia, 27 August 2021 | ASX: XETRA-DAX: NASDAQ INTERNATIONAL DESIGNATION: |

CUV UR9 CLVLY |

Download the PDF

Watch the Webinar

CLINUVEL PHARMACEUTICALS LTD held an investor and analyst webinar on the financial results for the year ended 30 June 2021 at 18:00 AEST on 26 August 2021. The webinar discussion is set out below:

Introduction

Mr Bull: Welcome to everyone joining us today for this briefing on the financial results of CLINUVEL PHARMACEUTICALS LTD for the financial year ending 30 June 2021. I am Malcolm Bull, Head of Investor Relations for CLINUVEL. Joining me to discuss the results is Dr Philippe Wolgen, Managing Director and Mr Darren Keamy, Chief Financial Officer. Welcome Philippe and Darren.

Mr Keamy: Hi Malcolm and greetings to everyone on the line.

Dr Wolgen: Good to be with you.

Mr Bull: We’re streaming this webinar at six in the evening in Melbourne so European investors can dial in at the start of their business day, noting it is very early morning for US attendees.

The format of today’s webinar is to ask Darren as CFO to provide details of the results for the year ending 30 June 2021, and I will also invite Dr Wolgen to comment on the results from a MD’s operational and strategic viewpoint.

We have received a number of questions from shareholders and analysts which are covered in this webinar and, although questions may still be posted during the webinar, we may not be able to address them all in the time we have today.

Please note, the FY2021 results were posted 8 hours ago to the Australian Securities Exchange, with News Communiqué IV and a general corporate presentation. CLINUVEL has received a number of requests for press interviews, and our Managing Director has presented today to TV and print media, and will address the German speaking shareholders on Friday via a YouTube interview. Finally, note that all figures mentioned and reported are in Australian dollars, and attendees are advised to refer to the Appendix 4E Preliminary Financial Report on our website for more detail.

Discussion

Mr Bull: Without further ado, Mr Keamy, Darren, can you first provide a summary of the results as announced to the ASX earlier today?

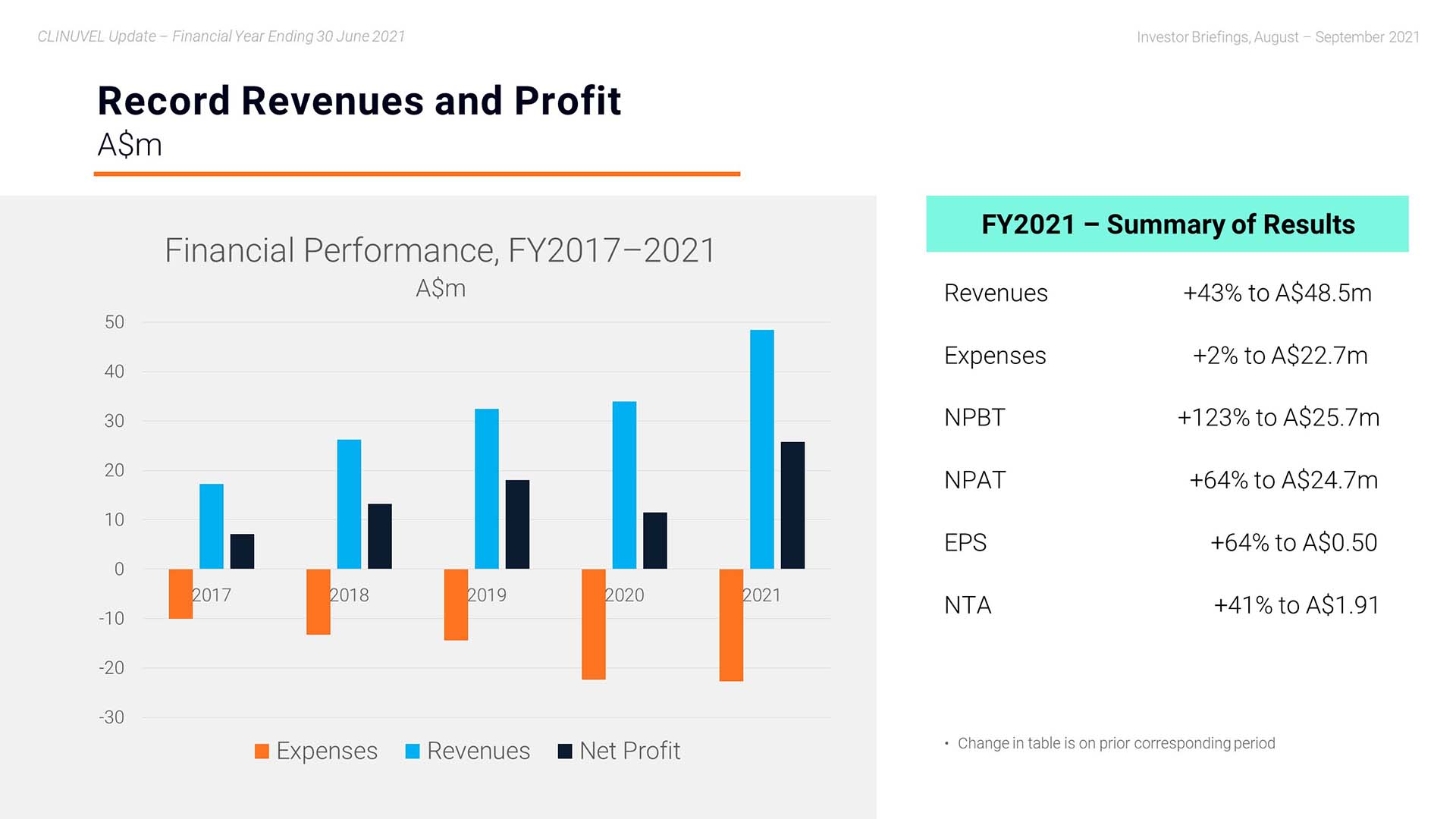

Mr Keamy: Yes, it is my pleasure. We start off with the headline revenues, expenses, and profit figures. In the 2021 financial year, the CLINUVEL Group achieved record annual revenues of $48.451 million . This is a 43% increase compared to the 2020 financial year. At $22.738 million, expenses were relatively constant with an increase of only 2% to the previous year. Net profit before tax was also a record $25.713 million and the after tax profit result was $24.728 million – another high for CLINUVEL.

Mr Bull: Thanks Darren. Before we delve into the results, the audience today may like to know how you interpret these results as the longstanding CFO of the Company?

Mr Keamy: Overall, it is an excellent result. FY2021 is the fifth consecutive year of positive cash flow and profit since we commenced commercial operations in June 2016 in Europe following the marketing authorisation granted by the European Medicines Agency. It also marks the first full year of commercial operations in the USA, which have made a meaningful contribution to this year’s result. It is extremely satisfying to have been a part of a growth story in CLINUVEL where the journey has taken me through the research and development phase to commercialisation of SCENESSE® and now, to be working on the growth of commercial operations and the expansion of the research and development program to treat other patient groups and to develop new products.

Mr Bull: I agree with you that these are excellent results and should fill all stakeholders of CLINUVEL with pride. I now wish to invite our Managing Director, Dr Philippe Wolgen to comment on the results for FY2021.

Dr Wolgen: Thank you Mr Bull, Mr Keamy, not only for your commentary today but for the work done the past year.

CLINUVEL’s 2021 performance asks for a fundamental discussion of its operations and underlying business model.

Therefore, starting with the financial year 2021, we have aggressively increased our staff working from seven countries and four continents to ensure we better control distribution and market access and grow the Group’s research, development, and innovation capabilities. In doing so, we continued to invest, while we controlled our overall expenses with a 2% increase to A$22.7 million. In accounting for the direct and indirect costs, we reinvested more than 40% of our revenues to enable further organic growth.

In keeping with our mission to select, train and accredit prescribing centres and monitor physicians and patients longitudinally, we continued direct distribution to all hospitals and specialised medical centres within the European Economic Area and United States. Despite the various viral peaks and variants paralysing societies in Europe and the US, we managed to grow the number of accredited centres, number of patients and number of SCENESSE® administrations. In the US, our team managed to secure novel treatment codes, facilitating automatic processing by insurers to allow the hormonal treatment to reach porphyria patients faster.

As a result of making these resources available at times when the world was constricting, we actually grew total revenues by 43% yielding a PBIT which increased by 123% to A$25.7 million.

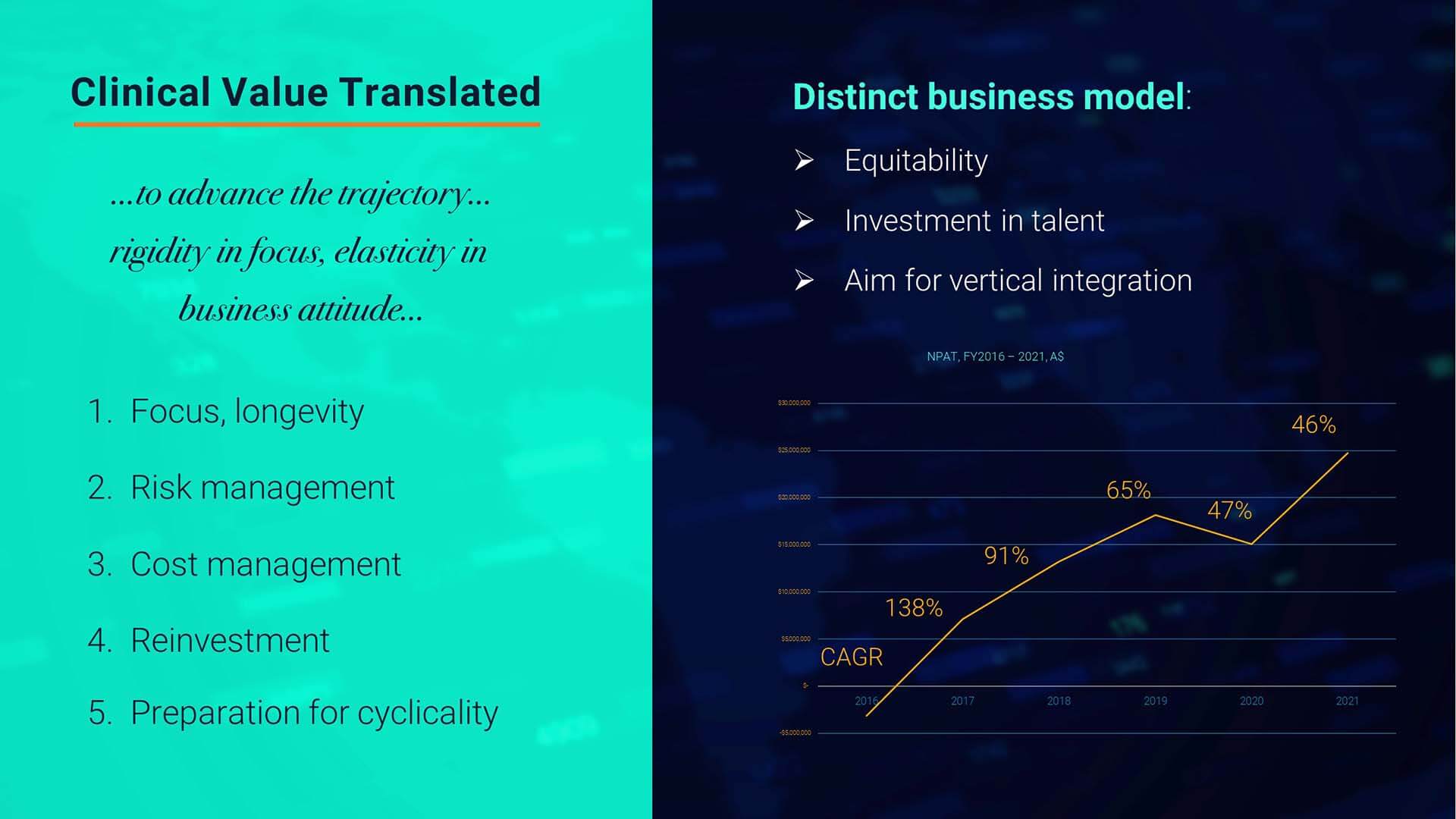

I am generally more interested in the long-range effects of our strategic measures, not just 12-month results. I want us to keep in mind a longer horizon. Therefore, we zoomed in on the compounded annual growth rate since 2016, with a CAGR of 46% the past 12 months. The solid trend in revenues the past five years needs a note to FY2020, since a percentage of the orders and payments occurred prior to the book year 2020. So, in all, we witness a linear compounded growth for five consecutive years with a double-digit expansion rate.

As you see in the graph, the orientation of expenditures reflects our gradual and controlled increase in research, development, and innovation. As our shareholders are used to from us, expenditures have been scrupulously controlled, and the financial management of capital has largely contributed to the strong balance sheet of the Group we enjoy today to withstand cyclicality in markets.

Our expenditures have grown year on year but levelled off from FY2020 in FY2021.

Taking these considerations further, we now zero in on net profits after income tax as found over the last five years.

Again, here one sees double digit increases each year and for FY2021, a CAGR of 51% in net profits over FY2020.

As alluded to moments ago, we chose in 2014 a distinct commercial approach which would provide CLINUVEL a competitive advantage, yet not habitual in the pharmaceutical sector, and certainly a less familiar path for ASX- listed pharmaceutical companies: we established our own teams in the EEA & US to execute a formal hospital- monitoring program providing essential long-term safety data and measures of efficacy. Staying with the same anthem, we instituted a market access and distribution team to directly engage with insurers on both sides of the Atlantic.

For the new attendees and shareholders today, in 2014 we judged three corporate options whether to:

- sell CLINUVEL to a larger pharma company;

- enter a license agreement to distribute SCENESSE®; or

- integrate all commercial functions and go ourselves.

Today’s glowing results not only fortify once more the linear trajectory of CLINUVEL, but the numbers directly correlate with the risk analyses we made in 2014 and the decision we made as a Board to set up EU and US operations ourselves. This very decision has greatly benefited patients and their families, and the overwhelming majority of CLINUVEL’s shareholders. At this point in time, I must publicly acknowledge all my staff and the Board, all the cogs – small and large – who have made the CLINUVEL timepiece tick with precision and constancy, while putting this performance against the most challenging operational and economic conditions.

These results provide a foundation for more activities, further expansion, organically and inorganically.

Mr Bull: Thank you Dr Wolgen. Mr Keamy, you commented in the past on the sustainability of the business – can you give us your thoughts on this topic?

Mr Keamy: As I previously mentioned, we have just posted our fifth consecutive profit, and our cash reserves have increased to a level that should be sufficient to self-finance our planned expansion. This indicates fiscal sustainability, but it’s not just about what we have achieved financially. It’s also how we have evolved the business processes to achieve long term sustainability. We strive to be able to independently operate without risk of insolvency. We have come a long way since when I first joined the Company when we had around two quarters of cash in the bank, so we feel well placed to serve our patients and stakeholders.

We are committed to grow the commercial part of the business and translate our pharmaceutical technology to other indications and also wider populations who have an unaddressed need of protection and DNA Repair.

These are potentially larger markets than the existing pharmaceutical business based on the treatment of EPP patients. So, we are working in parallel on long term growth to progress our recent track record into many more years of positive performance.

Mr Bull: Let’s now delve into the results, starting with revenues. What has driven the significant rise in revenues?

Mr Keamy: I’ll cover Europe first, then the USA.

In Europe, revenues were impacted in the second half of the previous financial year by the initial COVID-19 wave that spread across the continent. During the 2021 financial year we saw patients who had found it difficult to get treatment return to Expert Centres and new patients also receive treatment. Overall, there was a rise in revenues in the European Economic Area although its impact was constrained by the conversion of Euro revenues to our Australian dollar reporting currency which strengthened during the financial year.

In the USA, we commenced commercial operations in April 2020, which provided only initial orders in the FY2020 result. The completed financial year 2021 is therefore a good measure how we enter a new continent, implementing a system to run our US commercial operations.

We have experienced strong physician’s willingness to prescribe the new treatment, and training and accreditation required much of our resources and time. We expanded the number of Specialty Centers throughout the US, and the insurances needed to be engaged in each state with their own rules and regulations. As Dr Wolgen stated, we secured novel treatment codes for a prescriptive treatment which had not existed before for these insurers, so we needed to educate each and every insurer in all US states. In general, there is a lot of red tape to go through to get a new treatment on an insurers’ list. We did well and obtained faster Prior Authorization status from individual insurers than what we did in FY2020. This resulted in faster turnaround times, less travel time and faster booking of appointments by patients.

In addition, our team in the US, led by Dr Linda Teng has done an outstanding job in distributing and assisting insurers and patients, the same way Mrs Colucci, Dr Hamila and Mr Hay have accomplished in Europe.

The US team have trained and accredited over 40 centres compared to our plan of 30 by the end of 2021 and we have over 60 national and state based private insurers reimbursing the cost of treatment under Prior Authorization. Some of our US patients have now experienced year-round treatment. This reflects a willingness, from patients to continue treatment and it demonstrates the value our drug provides to our patients.

Finally, in 2021, we entered a new region, the Middle East, by obtaining a breakthrough in Israel, the right to distribute SCENESSE® to patients who live all year around in an isolated state due to the intensity of light and intense heat.

Mr Bull: Let’s dig into the US roll out a little further. Can you provide more information on US cash receipts, as well as the receipt cycle in Europe compared to the US?

Mr Keamy: In the US, based on our experiences so far, cash receipts are expected to be less seasonal since the approval of the FDA allows treatment every 60 days and thus treatment may be provided all year round. This means for the same number of patients the frequency of treatments provided can be higher in some states all year around compared to Europe, and cash receipts would follow this trend. Furthermore, the cash receipt cycle in Europe is fairly short with payment being made to CLINUVEL in around 30 to 60 days from placement of order. In the US, the cycle seems longer. With the new and unique treatment codes, this period may well reduce.

Mr Bull: A shareholder has asked: what is the pricing policy of the Company?

Mr Keamy We operate a uniform net price for SCENESSE® per continent, reflecting our frequent communication on this topic and our values of fairness and equitability to patients, physicians, and insurers. We have two different distribution systems, one for the US and one for the EEA, which presses on us to treat the insurers in an equitable manner in the US, while treating all EU insurers on par. The reception from US insurers and EU payors has been very positive, since the Company behaves differently than most other pharmaceuticals. We are now working to implement a CPI increase in price in Europe, since the price has not changed since we commenced commercial operations in 2016, but costs have increased year-on-year.

Mr Bull: I wish to discuss the expenses, Darren, and reflecting shareholder comments received, expenses grew by 2%, far less than FY2020. Why is this, given that CLINUVEL has increased its commercial operations and expanded our clinical programs?

Mr Keamy: Last year we already spent much on capital infrastructure and expenditures towards our new facilities in Singapore. This year the 2% increase is owing to reinvestment in research, development, and innovation, new qualified and experienced managers, and expenditures towards raw materials and supplies. There were also increases in costs across the business, additionally freight and handling expenses, partly offset by savings in several areas such as, the cost of responding to regulatory audits, bringing communication and marketing services ‘in-house’ and reduced local and international staff travel due to the coronavirus pandemic. Thus, the increase this year was modest compared to the larger increase of over 55% in the previous financial year. The costs therefore, on balance, remained the same, but still over the last two years expenses have increased by 58% to support the growth and expansion of the Group’s activities. I know Dr Wolgen will be addressing the outlook for expenses in the next Strategic Update in September and thus investors and analysts can look to further insights then.

Mr Bull: Do you foresee increase in costs of the clinical program since the world and hospitals start to pay attention again to clinical trials?

Mr Keamy: Certainly, the commencement of a larger vitiligo study would see R&D expenses increase, bearing in mind that the Phase II clinical studies in XP and AIS are smaller in size. Over time, larger studies will have an impact on the absolute value of R&D expenses and our R&D expenses will increase as we further progress new products and formulations. Whether R&D expenses will rise as a proportion of total expenses depends on the need to incur expenses to support growth in other areas of the business.

Mr Bull: I know we will be working hard on the revenues side of the business to ensure the scissors of revenues and expenses will open up to further positive outcomes in the coming years.

This time last year you said that you see your task as CFO of an ASX-200 company to operate as a going concern as well as providing the Company a robust financial buffer as the best foundation for growth. Now, this is not your performance assessment, but how are you going on this?

Mr Keamy: If that was my performance assessment then I think I have a tick by my name! However, a record profit should be celebrated whenever it is achieved. I congratulate all CLINUVEL personnel for their role in this outcome and thank all our stakeholders for their support. It is good to know that the foundation for growth is there. We have over eighty million Australian dollars in cash which is sufficient to self-finance our planned expansion and to manage potential economic adversity. This is an enviable position and one that benefits shareholders.

Mr Bull: We received a question about growth through acquisition, inorganic growth. Perhaps, this is something Dr Wolgen can comment on?

Dr Wolgen: For a number of years, we have publicly discussed our quest to add more technologies to our portfolio of R&D projects. To put this in context, we invest in what we know and what we need. We translate our technologies in a DNA Repair program, vitiligo, and brain diseases such as ischaemic stroke.

An acquisition needs to be accretive and complement our existing activities and meet our objectives. We are scanning continuously and are doing diligence on a variety of companies, and we are closing in on some opportunities which add value to our existing operations. So yes, it is one of our objectives, and I am confident we will grow inorganically too.

In the next Strategic Update III, we will discuss some of these aspects but also our organic growth and why we are aiming to complete the transition from a single-focused to a diversified group. Our aim is to arrive at a minimum of two pharmaceutical products, SCENESSE® and PRENUMBRA®, and four non-prescriptive products to a wider market, to complement and widen our pharmaceutical franchise.

Management obtained a mandate to establish several revenues centres, and this is what we are working towards in a methodical way.

Mr Bull: Thanks Dr Wolgen.

Mr Keamy: Let’s turn this on its head and if I can ask you Malcolm, can you summarise how our communications with shareholders has evolved over the last year?

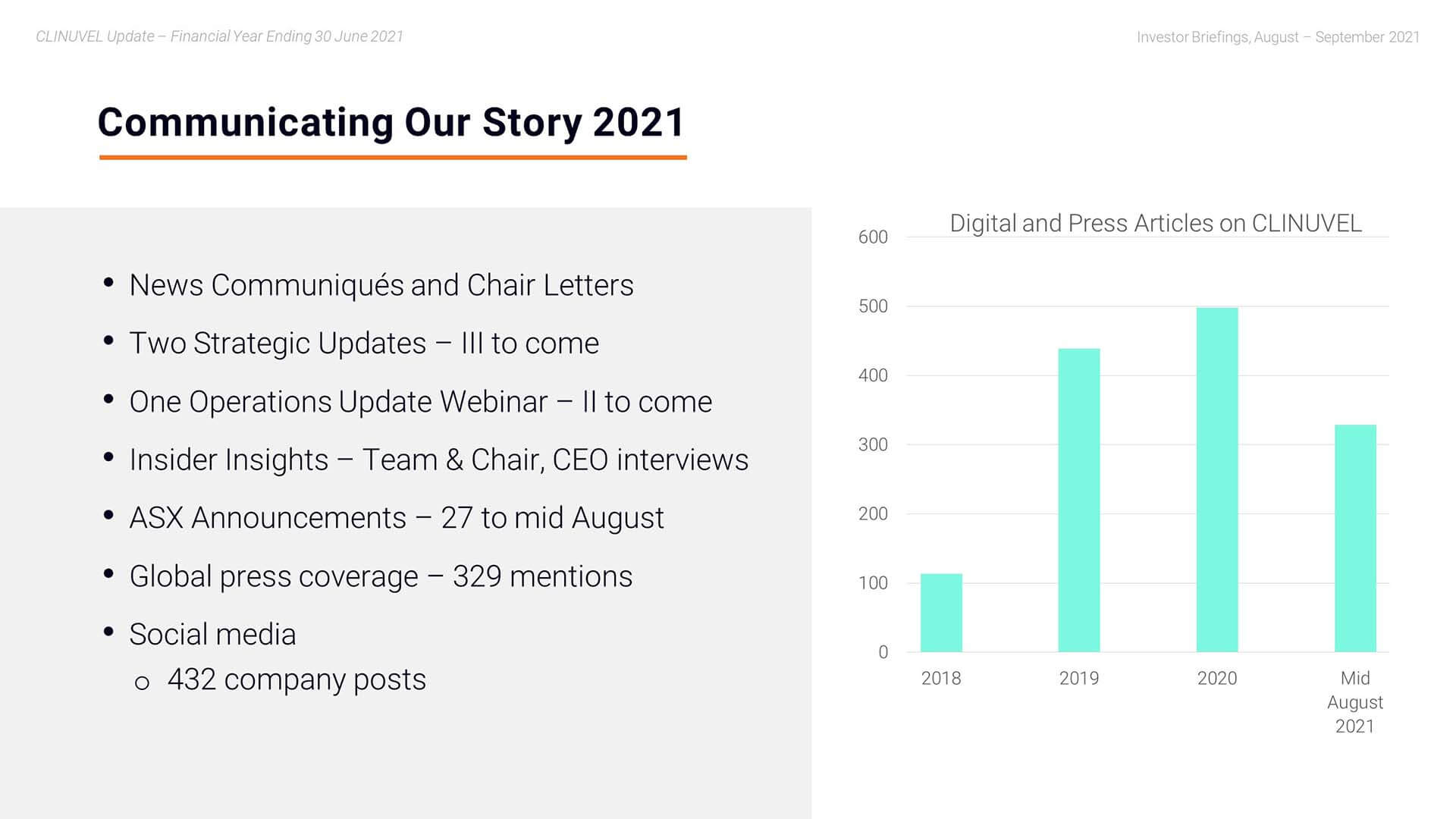

Mr Bull: Sure Darren, happy to explain that we have seen the past 24 months a significant increase in communications. We have built on our sector leadership in the frequency of communications through regular news communiqués and other announcements on the progress of the Company. We distinguish ourselves as an ASX-200 listed company by issuing six News Communiqués per annum, as well as a number of letters from the Chair. You can see in this slide, the trend in press mentions, noting the last bar is to mid-August and the previous bars are annual.

We continued to address a large pool of German speaking shareholders by translating the News Communiqués into German. We have also diversified the way we communicate. We did more webinars, videos, and conference presentations this year ranging from the Operations Webinar to the Strategic Update and video interviews with the CEO and Chair. We presented our evolving story to more key conferences than before and held many meetings around the conferences and also throughout the year, whether they be one-on-one or group forums. For example, we leverage our relationship with the expanded number of independent analysts of CLINUVEL who host investor meetings involving their clients who are our existing or potential investors in CLINUVEL. Our communications team also use social media channels to communicate our story.

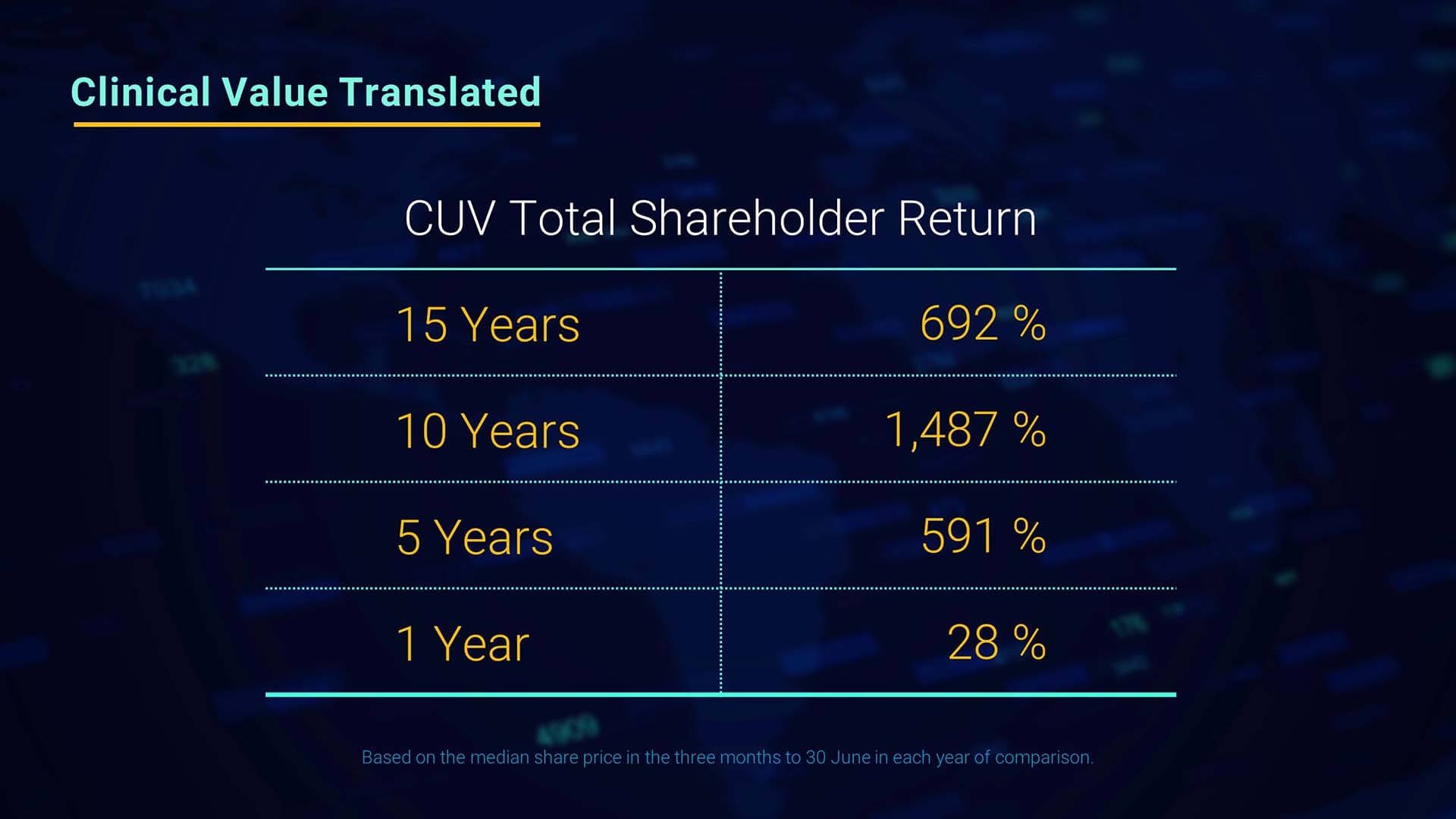

Since I have the floor, I’d like to change tact and draw attention to the benefit to shareholders of CLINUVEL’s performance over the years. The chart presented here shows the significance of total shareholder return based on the change in the share price. These are outstanding returns for shareholders.

Mr Keamy: Thanks Malcolm, I agree.

Conclusion

Mr Bull: I think we have covered the excellent financial results well in this session. So, at this point, I thank our Managing Director and CFO for your insights. I would also like to thank our independent analysts and particularly, Messer’s David Blake and Mark Pashacz of Bioshares, Mrs Sarah Mann of Moelis, Dr Stanton and Mrs Thomson of Jefferies, and Drs Storey and Benson of Wilsons, as well as Chad Troja at Lonsec Research and Graham Witcomb at Intelligent Investor, for their efforts to keep investors informed on CLINUVEL over the past year.

Mr Keamy: Thank you Malcolm. I look forward to the next opportunity to talk about our Company and thank you to all who have attended.

Dr Wolgen: Thank you everyone for your interest in CLINUVEL.

Mr Bull: Yes, thank you to everyone who has joined in. We expect over the coming month to provide another Strategic Update, Number III, from the Managing Director and a second Operations Update webinar. See you all soon.

– End –

CLINUVEL’s Appendix 4E Preliminary Financial Report is available on the Company’s website, www.clinuvel.com.

SCENESSE® (afamelanotide 16mg) is approved in the European Union and Australia as an orphan medicinal product for the prevention of phototoxicity in adult patients with erythropoietic protoporphyria (EPP). SCENESSE® is approved in the USA to increase “pain-free” light exposure in adult EPP patients with a history of phototoxicity. Information on the product can be found on CLINUVEL’s website at www.clinuvel.com.

About CLINUVEL PHARMACEUTICALS LIMITED

CLINUVEL PHARMACEUTICALS LTD (ASX: CUV; NASDAQ INTERNATIONAL DESIGNATION ADR: CLVLY; XETRA-DAX: UR9) is a global and diversified biopharmaceutical company focused on developing and commercialising treatments for patients with genetic, metabolic, and life-threatening disorders, as well as healthcare solutions for the general population. As pioneers in photomedicine and understanding the interaction of light and human biology, CLINUVEL’s research and development has led to innovative treatments for patient populations with a clinical need for systemic photoprotection, DNA repair and acute or life-threatening conditions. These patient groups range in size from 5,000 to 45 million worldwide. CLINUVEL’s lead compound, SCENESSE® (afamelanotide 16mg), was approved by the European Commission in 2014, the US Food and Drug Administration in 2019 and the Australian Therapeutic Goods Administration in 2020 for the prevention of phototoxicity (anaphylactoid reactions and burns) in adult patients with erythropoietic protoporphyria (EPP). More information on EPP can be found at http://www.epp.care. Headquartered in Melbourne, Australia, CLINUVEL has operations in Europe, Singapore and the USA. For more information please go to http://www.clinuvel.com.

SCENESSE® and PRÉNUMBRA® are registered trademarks of CLINUVEL PHARMACEUTICALS LTD.

Authorised for ASX release by the Board of Directors of CLINUVEL PHARMACEUTICALS LTD

Media Enquiries

Monsoon Communications

Mr Rudi Michelson, 61 411 402 737, rudim@monsoon.com.au

Head of Investor Relations

Mr Malcolm Bull, CLINUVEL PHARMACEUTICALS LTD

Investor Enquiries

https://www.clinuvel.com/investors/contact-us

Forward-Looking Statements

This release contains forward-looking statements, which reflect the current beliefs and expectations of CLINUVEL’s management. Statements may involve a number of known and unknown risks that could cause our future results, performance, or achievements to differ significantly from those expressed or implied by such forward-looking statements. Important factors that could cause or contribute to such differences include risks relating to: our ability to develop and commercialise pharmaceutical products, the COVID-19 pandemic affecting the supply chain for a protracted period of time, including our ability to develop, manufacture, market and sell biopharmaceutical products; competition for our products, especially SCENESSE® (afamelanotide 16mg); our ability to achieve expected safety and efficacy results through our innovative R&D efforts; the effectiveness of our patents and other protections for innovative products, particularly in view of national and regional variations in patent laws; our potential exposure to product liability claims to the extent not covered by insurance; increased government scrutiny in either Australia, the U.S., Europe, China and Japan of our agreements with third parties and suppliers; our exposure to currency fluctuations and restrictions as well as credit risks; the effects of reforms in healthcare regulation and pharmaceutical pricing and reimbursement; that the Company may incur unexpected delays in the outsourced manufacturing of SCENESSE® which may lead to it being unable to supply its commercial markets and/or clinical trial programs; any failures to comply with any government payment system (i.e. Medicare) reporting and payment obligations; uncertainties surrounding the legislative and regulatory pathways for the registration and approval of biotechnology based products; decisions by regulatory authorities regarding approval of our products as well as their decisions regarding label claims; any failure to retain or attract key personnel and managerial talent; the impact of broader change within the pharmaceutical industry and related industries; potential changes to tax liabilities or legislation; environmental risks; and other factors that have been discussed in our 2021 Preliminary Final Report. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation, outside of those required under applicable laws or relevant listing rules of the Australian Securities Exchange, to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. More information on the forecasts and estimates is available on request. Past performance is not an indicator of future performance.

www.clinuvel.com

Level 11

535 Bourke Street

Melbourne – Victoria, Australia, 3000

T +61 3 9660 4900

F +61 3 9660 4999