Appendix 4C & Activity Report

| Melbourne, Australia, 28 April 2022 | ASX: XETRA-DAX: ADR Level 1: |

CUV UR9 CLVLY |

CLINUVEL PHARMACEUTICALS LTD today released its Appendix 4C – Quarterly Cashflow Report and Activity Report for the period 01January to 31 March 2022.

| Highlights Cash Flow | ||

|---|---|---|

| Q3 FY20221 | Last 12 Months | |

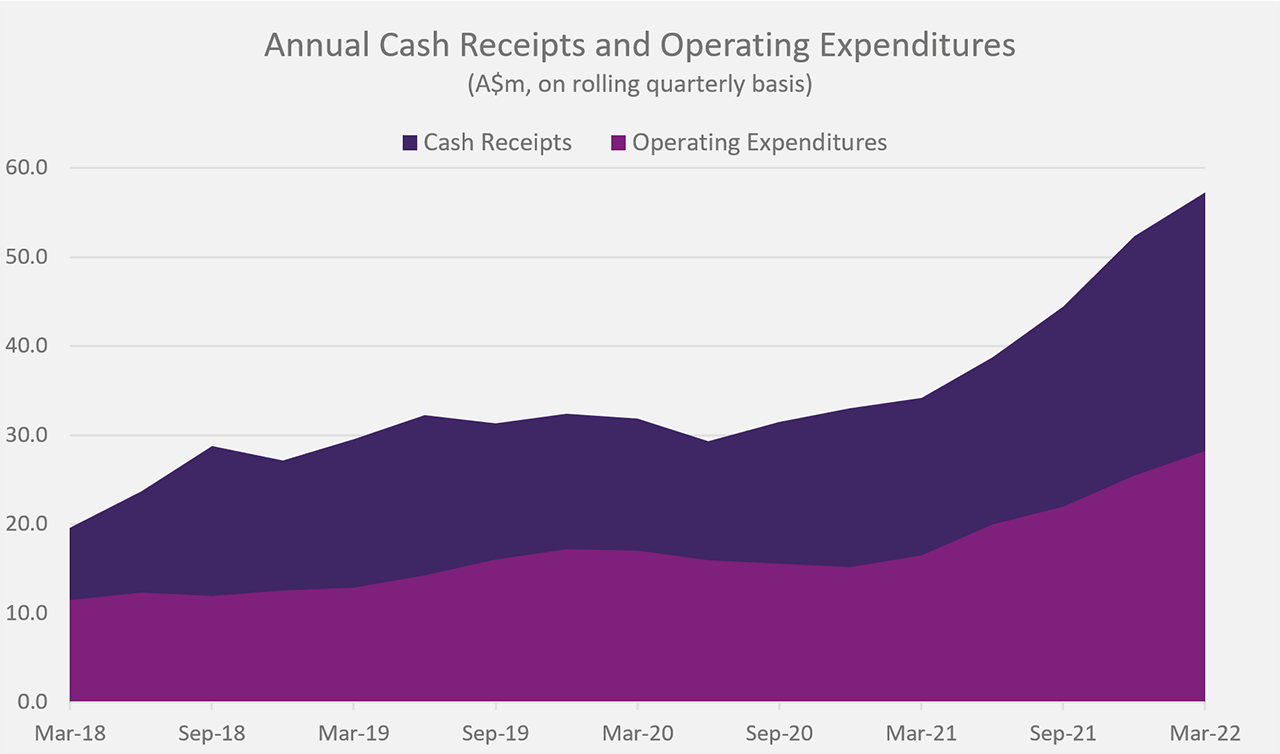

| Cash receipts4 | $11,442,000 | $57,266,000 |

| Operating Cash expenditures | $7,445,000 | $28,256,000 |

| Net operating cash flow2 | +$4,087,000 | $29,496,000 |

| Cash reserves3 | +2.9% | +36.0% |

| Debt-free | ||

|

The table provides context of the quarterly result ending 31 March 2022.

|

||

Record March Quarter

Further efficiencies in product distribution, increase in the number of prescribing centres, and rising patient demand for SCENESSE® (afamelanotide 16mg) were the main factors contributing to positive receipts for the March quarter for the Group. The further strength in performance enabled the Company to reinvest in research and development, and attract additional staff talent. In parallel, and according to projections, expenditures remained higher than average across the business units to provide for long-term growth. Overall, the Group recorded – for the first-time – cash and cash equivalents exceeding $100 million, serving as a buffer to respond to unforeseen adverse events and enabling further investments.

“After years of treatment, we see a gradual shift in a pattern of filling prescriptions by physicians providing all-year-round photoprotection to a growing number of erythropoietic protoporphyria (EPP) patients” CLINUVEL’s Chief Financial Officer, Darren Keamy said. “According to our projections, we are in the position to actively invest in new product development, capital equipment, clinical programs, infrastructure and – most importantly – specialised staff to build the company we envision.”

CLINUVEL’s cash receipts, coupled with prudent control of expenditures, are enabling the progress of a multi-pronged strategy to:

- grow commercial operations based on SCENESSE®;

- develop innovative melanocortin products to treat a range of indications with unmet medical need;

- provide non-prescription healthcare solutions to wider populations at highest risk of exposure to ultraviolet (UV) and high energy visible light (HEV); and

- further integrate critical parts of its supply chain.

Cash Receipts from Customers

CLINUVEL recorded cash receipts of $11,442,000 and net operating cash flows of $4,087,000 for the March quarter of 2021. The results in cash receipts exceed the next highest comparative result by 75%.

“Our teams on the ground directly assist the centres in streamlining insurance claims for reimbursement, in managing administrative obstacles and coding queries for the medical treatment provided,” Mr Keamy said. “In setting up the systems and processes, patients ultimately benefit from easier and faster access to treatment, and payment cycles reduce over time, as we see in these results.”

Cash Outflows

Operating expenditures totalled $7,445,000 for the quarter, whereby much went towards optimising the supply chain to meet clinical demand. Supply and manufacturing costs were impacted by rising inflationary pressure. Further increases in research and development expenditure were made. The cash outflows saw an impact since some annual administration and corporate expenditures were incurred at the start of the calendar year.

“Overall, we remain mindful of the growing pressures on costs worldwide. The inflation seen in the pharma industry also impacts CLINUVEL, as we absorb cost increases passed on by some of our key suppliers and service providers. More than ever, we emphasise our long-standing and consistent approach to managing a variable cost base in a controlled and deliberate manner. It is clear that we need to balance successful execution of operations with expected reinvestments to secure growth. The cash generated allows us to seize opportunities as they are presented,” Mr Keamy said.

KEY ACTIVITIES – MARCH QUARTER 2022

Commercial Operations

CLINUVEL continued the commercial distribution of SCENESSE® for EPP in Europe, the USA, and Israel during the March quarter 2022 to meet ongoing and growing patient demand for treatment.

In January 2022, the Company announced a second agreement with the German National Association of Statutory Health Insurance Funds (GKV-SV). Negotiated over 18 months, the agreement ensures ongoing access to SCENESSE® treatment for German EPP patients. The extensive negotiation process and the significance of the outcome for the ongoing treatment of EPP patients was discussed in detail in News Communiqué I.

Progress of Clinical Programs

CLINUVEL is actively conducting clinical trials to evaluate the safety and efficacy of melanocortins – including afamelanotide – for a range of patients with genetic, metabolic, systemic, and life-threatening, acute disorders. The expanded clinical program progressed during the quarter with key developments in individual programs is reported below.

| Study | Status |

|---|---|

| CUV156 adult xeroderma pigmentosum C (XP-C) patients | Study ongoing. Results expected in 2022. |

| CUV151 disease free adult subjects | First subject dosed in February 2022. Results expected in 2022. |

| CUV152 adult xeroderma pigmentosum V & C (XP-V/XP-C) patients | First XP-V patient dosed in March. Results expected in 2022. |

| Study | Status |

|---|---|

| Study | Status |

|---|---|

| CUV104 adult vitiligo patients with darker skin complexion (Fitzpatrick IV-VI) | Study design agreed with the US Food and Drug Administration (FDA). First patient dosing expected in 2022. |

Melanocortin Drug Portfolio

In March 2022, CLINUVEL provided an update on the scaled manufacture of adrenocorticotropic hormone (ACTH) for the novel NEURACTHEL® product formulations. The drug substance is being manufactured under current Good Manufacturing Practices by a strategic partner and is undergoing development and validation work. NEURACTHEL® will be evaluated for patients with neurological, endocrinological and degenerative disorders, who lack alternative therapy.

Healthcare Solutions

The Operations Update I – 2022 Webcast in February 2022 provided an update on the Group’s planned launch of its first product line of dermatocosmetics range. CLINUVEL is preparing its distribution processes, implementing necessary knowhow and putting together digital teams to engage with specific audiences at highest risk from exposure to ultraviolet and high energy visible light. The identified audiences are underserved in current markets.

Other Activities and Announcements

All of the Company’s announcements in the March quarter 2022 are available on the CLINUVEL website, with other updates available on the CLINUVEL News website.

Although the Company is no longer obligated under ASX Listing Rules to publish quarterly cash flow results, it elects to continue to do so to keep its global investors updated regularly. A copy of the Appendix 4C – Quarterly Cash Flow Report for the second quarter of FY2022 is attached.

Pursuant to Listing Rule 4.7C and as disclosed in Item 6.1 to the attached Appendix 4C, $1,046,000 were recorded in respect to Non-Executive Directors’ fees, Managing Director’s fees and non-monetary benefits (inclusive of non-monetary and non-cash benefits and unused and long accrued annual leave entitlement to Managing Director).

– End –

1 SCENESSE® (afamelanotide 16mg) is approved in the European Union and Australia as an orphan medicinal product for the prevention of phototoxicity in adult patients with erythropoietic protoporphyria (EPP). SCENESSE® is approved in the USA to increase “pain-free” light exposure in adult EPP patients with a history of phototoxicity. Information on the product can be found on CLINUVEL’s website at www.clinuvel.com.

About CLINUVEL PHARMACEUTICALS LIMITED

CLINUVEL (ASX: CUV; ADR LEVEL 1: CLVLY; XETRA-DAX: UR9) is a global specialty pharmaceutical group focused on developing and commercialising treatments for patients with genetic, metabolic, systemic, and life-threatening, acute disorders, as well as healthcare solutions for the general population. As pioneers in photomedicine and the family of melanocortin peptides, CLINUVEL’s research and development has led to innovative treatments for patient populations with a clinical need for systemic photoprotection, DNA repair, repigmentation and acute or life-threatening conditions who lack alternatives.

CLINUVEL’s lead therapy, SCENESSE® (afamelanotide 16mg), is approved for commercial distribution in Europe, the USA, Israel and Australia as the world’s first systemic photoprotective drug for the prevention of phototoxicity (anaphylactoid reactions and burns) in adult patients with erythropoietic protoporphyria (EPP). Headquartered in Melbourne, Australia, CLINUVEL has operations in Europe, Singapore and the USA. For more information, please go to https://www.clinuvel.com.

SCENESSE®, PRÉNUMBRA® and NEURACTHEL® are registered trademarks of CLINUVEL PHARMACEUTICALS LTD.

Authorised for ASX release by the Board of Directors of CLINUVEL PHARMACEUTICALS LTD

Media Enquiries

Monsoon Communications

Mr Rudi Michelson, 61 411 402 737, rudim@monsoon.com.au

Head of Investor Relations

Mr Malcolm Bull, CLINUVEL PHARMACEUTICALS LTD

Investor Enquiries

https://www.clinuvel.com/investors/contact-us

Forward-Looking Statements

This release contains forward-looking statements, which reflect the current beliefs and expectations of CLINUVEL’s management. Statements may involve a number of known and unknown risks that could cause our future results, performance or achievements to differ significantly from those expressed or implied by such forward-looking statements. Important factors that could cause or contribute to such differences include risks relating to: our ability to develop and commercialise pharmaceutical products; the COVID-19 pandemic and/or other world, regional or national events affecting the supply chain for a protracted period of time, including our ability to develop, manufacture, market and sell biopharmaceutical products; competition for our products, especially SCENESSE® (afamelanotide 16mg), PRÉNUMBRA® or NEURACTHEL®; our ability to achieve expected safety and efficacy results in a timely manner through our innovative R&D efforts; the effectiveness of our patents and other protections for innovative products, particularly in view of national and regional variations in patent laws; our potential exposure to product liability claims to the extent not covered by insurance; increased government scrutiny in either Australia, the U.S., Europe, Israel, China and Japan of our agreements with third parties and suppliers; our exposure to currency fluctuations and restrictions as well as credit risks; the effects of reforms in healthcare regulation and pharmaceutical pricing and reimbursement; that the Company may incur unexpected delays in the outsourced manufacturing of SCENESSE®, PRÉNUMBRA® or NEURACTHEL® which may lead to it being unable to supply its commercial markets and/or clinical trial programs; any failures to comply with any government payment system (i.e. Medicare) reporting and payment obligations; uncertainties surrounding the legislative and regulatory pathways for the registration and approval of biotechnology and consumer based products; decisions by regulatory authorities regarding approval of our products as well as their decisions regarding label claims; our ability to retain or attract key personnel and managerial talent; the impact of broader change within the pharmaceutical industry and related industries; potential changes to tax liabilities or legislation; environmental risks; and other factors that have been discussed in our 2021 Annual Report. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation, outside of those required under applicable laws or relevant listing rules of the Australian Securities Exchange, to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. More information on preliminary and uncertain forecasts and estimates is available on request, whereby it is stated that past performance is not an indicator of future performance.

www.clinuvel.com

Level 11

535 Bourke Street

Melbourne – Victoria, Australia, 3000

T +61 3 9660 4900

F +61 3 9660 4999

Appendix 4C

Quarterly cash flow report for entities subject to Listing Rule 4.7B

Name of entity

CLINUVEL PHARMACEUTICALS LIMITED

ABN

88 089 644 119

Quarter ended (“current quarter”)

31 MARCH 2022

| Consolidated statement of cash flows | Current quarter $A’000 |

Year to date (9 months) $A’000 |

|

|---|---|---|---|

| 1 | Cash flows from operating activities | ||

| 1.1 | Receipts from customers | 11,442 | 42,347 |

| 1.2 | Payments for | ||

| research and development | (310) | (881) | |

| product manufacturing and operating costs | (2,878) | (8,537) | |

| advertising and marketing | (80) | (254) | |

| leased assets | (74) | (234) | |

| staff costs | (2,837) | (8,637) | |

| administration and corporate costs | (1,247) | (3,014) | |

| 1.3 | Dividends received (see note 3) | – | – |

| 1.4 | Interest received | 90 | 203 |

| 1.5 | Interest and other costs of finance paid | (10) | (27) |

| 1.6 | Income taxes paid | (93) | (93) |

| 1.7 | Government grants and tax incentives | 0 | 210 |

| 1.8 | Other (provide details if material) | 85 | 311 |

| 1.9 | Net cash from / (used in) operating activities | 4,088 | 21,394 |

| 2 | Cash flows from investing activities | ||

| 2.1 | Payments to acquire or for: | ||

| (a) entities | – | – | |

| businesses | – | – | |

| property, plant and equipment | (181) | (237) | |

| investments | – | – | |

| intellectual property | – | – | |

| other non-current assets | – | – | |

| 2.2 | Proceeds from disposal of: | – | – |

| (b) entities | |||

| businesses | – | – | |

| property, plant and equipment | – | – | |

| investments | – | – | |

| intellectual property | – | – | |

| other non-current assets | – | – | |

| 2.3 | Cash flows from loans to other entities | – | – |

| 2.4 | Dividends received (see note 3) | – | – |

| 2.5 | Other (provide details if material) | – | – |

| 2.6 | Net cash from / (used in) investing activities | (181) | (237) |

| 3 | Cash flows from financing activities | ||

| 3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) | – | – |

| 3.2 | Proceeds from issue of convertible debt securities | – | – |

| 3.3 | Proceeds from exercise of options | – | – |

| 3.4 |

Transaction costs related to issues of equity securities or convertible debt securities |

– | – |

| 3.5 | Proceeds from borrowings | – | – |

| 3.6 | Repayment of borrowings | (58) | (188) |

| 3.7 | Transaction costs related to loans and borrowings | – | – |

| 3.8 | Dividends paid | – | (1,235) |

| 3.9 | Other (provide details if material) | – | – |

| 3.10 | Net cash from / (used in) financing activities | (58) | (1,423) |

| 4 |

Net increase / (decrease) in cash and cash equivalents for the period |

||

| 4.1 | Cash and cash equivalents at beginning of period | 98,993 | 82,691 |

| 4.2 | Net cash from / (used in) operating activities (item 1.9 above) | 4,088 | 21,394 |

| 4.3 | Net cash from / (used in) investing activities (item 2.6 above) | (181) | (237) |

| 4.4 | Net cash from / (used in) financing activities (item 3.10 above) | (58) | (1,423) |

| 4.5 | Effect of movement in exchange rates on cash held | (991) | (574) |

| 4.6 | Cash and cash equivalents at end of period | 101,851 | 101,851 |

| 5 | Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts |

Current quarter $A’000 |

Previous quarter $A’000 |

|---|---|---|---|

| 5.1 | Bank balances | 37,486 | 39,864 |

| 5.2 | Call deposits | 64,050 | 58,800 |

| 5.3 | Bank overdrafts | – | – |

| 5.4 | Other (provide details) | 315 | 329 |

| 5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 101,851 | 98,993 |

| 6 | Payments to related parties of the entity and their associates | Current quarter $A’000 |

|---|---|---|

| 6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | 1,046 |

| 6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | |

| Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments. | ||

| 7 | Financing facilities

Note: the term “facility” includes all forms of financing arrangements available to the entity. Add notes as necessary for an understanding of the sources of finance available to the entity. |

Total facility amount at quarter end $A’000 |

Amount drawn at quarter end $A’000 |

|---|---|---|---|

| 7.1 | Loan facilities | ||

| 7.2 | Credit standby arrangements | ||

| 7.3 | Other (please specify) | ||

| 7.4 | Total financing facilities | ||

| 7.5 | Unused financing facilities available at quarter end | ||

| 7.6 | Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. | ||

| 8 | Estimated cash available for future operating activities | $A’000 |

|---|---|---|

| 8.1 | Net cash from / (used in) operating activities (item 1.9) | 21,390 |

| 8.2 | Cash and cash equivalents at quarter end (item 4.6) | 101,851 |

| 8.3 | Unused finance facilities available at quarter end (item 7.5) | 0 |

| 8.4 | Total available funding (item 8.2 + item 8.3) | 101,851 |

| 8.5 | Estimated quarters of funding available (item 8.4 divided by item 8.1) | N/A |

| Note: if the entity has reported positive net operating cash flows in item 1.9, answer item 8.5 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.5. | ||

| 8.6 | If item 8.5 is less than 2 quarters, please provide answers to the following questions: | |

| 8.6.1 | Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? | |

| Answer: N/A | ||

| 8.6.2 | Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? | |

| Answer: N/A | ||

| 8.6.3 | Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? | |

| Answer: N/A | ||

| Note: where item 8.5 is less than 2 quarters, all of questions 8.6.1, 8.6.2 and 8.6.3 above must be answered. | ||

Compliance statement

- This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

- This statement gives a true and fair view of the matters disclosed.

Date: 31 April 2022

Authorised by: MR DARREN KEAMY

(Name of body or officer authorising release – see note 4)

Notes

- This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

- If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standard applies to this report.

- Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

- If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”.

- If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.