CLINUVEL Communiqué I

Dear friends, shareholders,

We have entered a new year, one brimmed with optimism and hanging our hopes on the reversal of global health and the restart of our economies. Having adjusted in 2020 to an existence within new confounds, one foremost learns that unification in behaviour is required as sweeping vaccination is under way.

In planning and navigating CLINUVEL through economic times, we scan the globe. Geopolitically we are facing a European community adjusting post-Brexit and absorbing the last minute (24 December) Trade and Co operation Agreement between European Union (EU) and United Kingdom, whereby two distinct legal and regulatory spaces will exist; the free movement of goods and people ended on 31 December.

Equity markets surged to new records in 2020, and the expectation is that the bullish market will continue in 2021: the S&P500 Index disproportionately weighted by the FAANGS – reached a record at 3,859 on President Biden’s inauguration. Bond markets are of equal interest as we have seen from the recent sell-off in government bonds and longer term debt, while issuance of corporate bonds has reached new peaks driven by companies aiming for retention of cash ahead of uncertain commercial conditions.

We hold our breath when it comes to the strong rhetoric coming from North Korea and simmering tensions in the Middle East while normalisation accords have been signed between Israel and both the United Arab Emirates and Bahrain.

Central banks are continuing to inject liquidity in the markets, while credit to small businesses and households is slowing down in the EU. Retail banks in the Eurozone quell their angst of immutable debt and subsequently large-scale defaults.

We are starting from a low base when it comes to employment figures worldwide, but a blooming outlook should dominate.

In November 2020 (the last monthly period reported) employment in the EU rose by 1%. This increased total unemployment to 7.5% in the EU, where the portion of the workforce subject to furlough initiatives may distort the picture.

While pre-pandemic US unemployment was 3.5%, in April 2020 it had reached 14.8% to decline to 6.7% in December. Recovery is occurring but at a slow pace since a further 140,000 jobs were lost last month.

With a keen interest on the US, monetary policy in the US is poised to continue with the latest pledge by Treasury Secretary Nominee Janet Yellen to inject a further US$1.9 trillion in the US economy total (US$5.8 trillion since the start of the pandemic). The US called for further assistance to its domestic economy to navigate its current record federal deficit of US$900 billion (annualised). When it comes to servicing total US national debt of US$27 trillion, with current interest rates, the US government should not be less concerned at near-term impact. Controversy rages among leading economists when viewing the US trade deficit, as domestic consumption still outpaces exports, becoming more pertinent in light of the economic stand-off in trade between the US and China.

In Australia, unemployment rose to 7.6% in December 2020, having come from 5.2% in 2019, while projections are that a further rise to 8.9% may be foreseeable in 2021 depending on the containment imposed by Canberra. The economic outlook for Australia by its Reserve Bank is somehow more optimistic, with a projected 3.7% growth for 2021.

We have entered a new year, one brimmed with optimism and hanging our hopes on the reversal of global health and the restart of our economies

On the historical day of 20 January, we record the anniversary of the first COVID case reported in South Korea

COVID Update

Although the world is holding a firm grip on the new variant “SARSCoV- 2 VOC 202012/01” or “B.1.1.7.”, there is nevertheless room for confidence. The mutation which was discovered in England in late November takes place in the receptor binding domain (RBD) of the spike protein at position 501. This mutation is characterised by substitution of amino acid asparagine (N) with tyrosine (Y). The mutation is abbreviated as S:N501Y to specify that it is in the spike protein. At the time of print of this Communique, there are 20 known mutations.

A decisive clinical question is whether the variants with N501Y bind more tightly to the human angiotensin-converting enzyme 2 (ACE2) receptor on lung tissue or not.

The suggestion made is that the new variant could possibly evade vaccine induced immunity. The authorised vaccines from Pfizer-BioNTech, Moderna and Oxford-AstraZeneca are “polyclonal,” meaning these produce antibodies which target several parts of the spike protein. To escape immunity induced by vaccines or by natural infection, the virus would need to accumulate multiple mutations in the spike protein, and this will take time. In essence, it is a race against the clock which I believe man will eventually win. In January, five million Americans are set to receive vaccination, while the UK attempts to inoculate 14 million citizens by 15 February.

I also postulate that the current vaccination programs will rapidly exert their effects in Europe – and in the future, in developing nations across the world. At a rate of two million vaccinations per month, the UK is heading in the right direction, while Israel stands head and shoulders above the developed countries in speed of inoculation. It is expected that those vaccinated are likely to remain immunised for considerable time due to prolonged activity of antibodies, activated killer T-cells and circulating B-cells.

On the historical day of 20 January, we record the anniversary of the first COVID case reported in South Korea. While South Korea saw 879 deaths Spain, a country of similar population, saw over more than 50,000 mortalities. Both countries have shown us the relation between compliance and prevention. At CLINUVEL, we remind staff that caution will rule our mobility and conduct in 2021, and it is unlikely that we will return to “normal” operations during the year until vaccinations have reached levels of 70% of more and the R₀-number has fallen below 1.0 for considerable time in the EU, US, and Asia-Pacific.

However, against all the criticism uttered by popular press on scientific spending, one has sufficient reason for keeping faith in advancements as shown by the scientists, Drs Şahin and Türeci who managed to develop a first vaccine when the world needed it most. Let that scientific achievement be a bridge to discussing our own intentions and planning for 2021.

I also postulate that the current vaccination programs will rapidly exert their effects in Europe – and in the future, in developing nations across the world

Creeping Inflation and Impact on Pharmaceuticals

In News Communiqué IV, I shared CLINUVEL’s views on rising inflation and the possible impact on pockets of the economies but specifically pharmaceuticals, our area of focus for now.

Central banks globally will be aware of the enormous debt taken on by companies during the pandemic and the possible effect that raising interest rates would have on markets. As western governments realise the need to push global economic growth, monetary policies will continue for 2021.

Interest rates set by the Federal Open Market Committee in December were between 0% to 0.25%, taking us back to 2008, the midst of GFC, when rates remained at these benchmark levels until 2015. As we are now stuck at these levels, a question arises: when can rate hikes be expected as the US and G8 economies are showing signs of early recovery? From a widening yield curve (yield gap between short- and long-term government bonds), one gauges from the behaviour of global investors how they anticipate economic growth and expect a rise in interest rates.

Supply chain disruptions due to COVID, shortages and aggregate demand will, however, eventually lead to creeping prices, at least in US and the Eurozone. At the same time investors will increase their expectations of returns from asset classes, fixed income securities and equities. In December, the US Federal Reserve estimated real inflation to be around 1.4% currently, while most central banks keep an inflation target of 2%. I believe that inflation will reappear. The debate is when and how to prepare for it.

We look forward to restoration – or at a minimum – normalisation of economic ties with China. In further following the trade deficit of the US and China – currently at US$283 billion, a US$61 billion change from 2019 – we debate amongst ourselves how US interest rates are affected if US bonds continue to be sold off by foreign holders, such as China and Japan. The latter both hold around 8.7% of US national debt. China and US are caught in a spiral, as less Chinese exports means less US dollars to buy US Treasuries. The US dollar as the world’s reserve currency is at stake mid-term. We now witness a point where China is no longer dependent on the inflows of US dollars to see steady domestic growth.

With equal interest, we monitor the Australian relations to China as the country heavily depends on its export. The real impact of the political discord between Beijing and Canberra will be seen once the pandemic normalises trade; in the meantime Australian-Sino trade increased during 2020.

Some investors asked whether CLINUVEL would take advantage in the markets by taking on cheap debt, given our strength to pay off and service. Thus far we have not needed to change our debt-to-equity ratio, but we are periodically reviewing both our financial matrix and business needs.

Closer to our universe, with a recovery and economic growth in sight, pharmaceuticals have not yet been mentioned by the Biden administration as its spearheads reforms, although we believe drug pricing in the US will come under renewed attention as it had been part of the democratic election manifestos of Hilary Clinton and Bernie Sanders in 2016. One is reminded that in the second half of 2020 ex-President Trump issued a number of executive orders to cut drug prices, however he saw his efforts hampered by legal challenges.

One of the related themes interesting us is whether the DC lobbying machinery will be regaining momentum under Democrat rule, since the recoil of interest representation close to Washington’s decision makers remains a good indicator of the sector’s concern of upcoming regulatory changes.

Early January, 3 Axis – a leading consultancy specialising on pharmaceutical pricing – reported that the major global pharmaceutical companies had raised drug prices in 2020 across 840 medicines by an average of 5% and that it would be foreseen for 2021 that pharmaceutical pricing would increase ranging from 0.5% to 5%.

Central banks are continuing to inject

liquidity in the markets, while credit to small businesses and households is slowing down in the EU

CLINUVEL’s Year Ahead

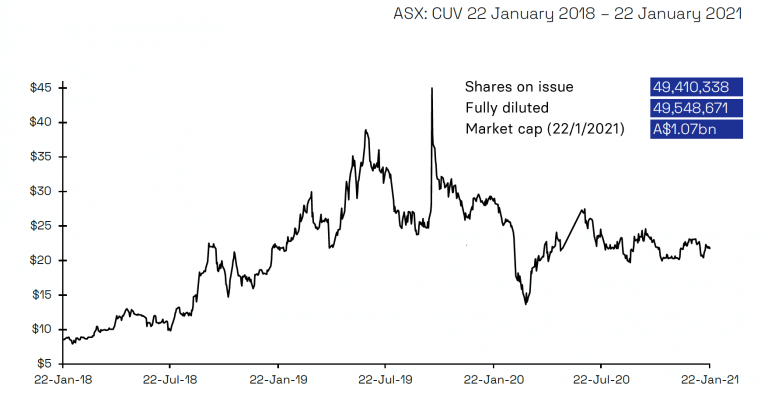

As a recap of 2020, on the ASX we evaluated 148 companies with a total market capitalisation (MCAP) of A$208 billion. On the 31 December, nine of these companies had a MCAP exceeding A$1 billion, and it is throughout foreseeable that we will see continuous growth of life science companies. CLINUVEL was the eighth largest by MCAP in Australia-New Zealand, but the second largest pure pharmaceutical drug developer, by a long distance, behind CSL. Pure pharmaceutical developers Down-Under are still lacking.

The COVID outbreak also plagues us through the uncertainty about healthcare facilities being able to provide chronic care to porphyria patients, but we have confidence in continuity during 2021. I am all too aware that in financial terms “past activities are no guarantee for future performance”, but by simply looking at the past 15 years, I know the fabric of this (our) CUV team and they stand to deliver once again amid challenging conditions.

Twenty-twenty-one is the year when we advance our DNA Repair Program and generate further data. By administering afamelanotide to the first stroke patient, we will observe how the hormonal treatment affects blood and oxygen supply to the acutely damaged brain. In this year, we strive to reach agreement with the US Food and Drug Administration (FDA) about the definition of addressable vitiligo market for afamelanotide. We refer the reader to the Strategic Update I provided on 29 October 2020 for further reading on our vitiligo program. We plan to complement our medical programs with OTC product lines aiming to serve a general population at higher risk.

To give further prominence to all activities, we are enlarging the Group with a comprehensive Communications, Branding and Marketing Division. We see digital communication and commercial activities as an unmissable part of our armamentarium for building a future house. In maintaining our high level of communication with six News Communiqués, four Scientific Communiqués, quarterly updates on our newly populated website clinuvel.com and less complex technical news via news.clinuvel.com, we stand out in frequency and volume of communication among AU and US life science companies. The frequency of news flow seems to be much appreciated from many of the shareholders, who are getting used to updates on commercial and operational aspects of the business. As was the case in 2020, our IR team will continue to publish News Communiqués bilingually in English and German to serve the relatively large population of German-speaking shareholders.

By design, the Group has been strengthened to diversify its activities. If all goes to plan and no unexpected externalities shower on our pharmaceutical operations, it will be a year when CLINUVEL increases its markets and prepare for further commercial activities to subsidise serial expansion on other domains.

With the array of synchrone projects and investments taking place, we look forward to the year. Introspectively, and staying within the realms of reality, our aim is for each new year to surpass the previous one; naturally, there will be a time when one levels off in performance, but in CUV’s case I believe we are far away from that point, and growth should be feasible for years to come. Across all shifts we require focus, discipline, and persistence.

To gain an in-depth view of the financial and operational news flow in 2021, CLINUVEL plans reporting and streaming to the ASX according to the following (subject to confirmation):

By design, the Group has been strengthened to diversify its activities

| 2021 | News flow | Comments |

|---|---|---|

| 23-30 Jan | News Communiqué I | |

| 27-31 Jan | Quarterly Cash Flow Statement | |

| 27-31 Jan | ASX – Appendix 4C | |

| 25-28 Feb | Financials Half Year | Pending sign-off and ratification by Auditors and Board |

| 25-28 Feb | ASX- Appendix 4D | |

| 26 Feb-8 Mar | Webinar: Operations Update I | |

| 10-Mar | Daiwa Investment Conference Tokyo | CUV presenting |

| 23-30 Mar | News Communiqué II | |

| 01-07 Apr | Strategic Update II | Corporate Update Expansion Strategy |

| 25-30 Apr | Quarterly Cash Flow Statement | |

| 25-30 Apr | ASX – Appendix 4C | |

| 23-30 May | News Communiqué III | |

| 24-26 May | UBS Global Healthcare Virtual Conference | CUV presenting* |

| Jun (TBC) | Goldman Sachs Global Healthcare Conference | CUV presenting* |

| 08-10 Jun | Jefferies Global Healthcare Conference | CUV presenting* |

| 25-31 Jul | Quarterly Cash Flow Statement | |

| 25-31 Jul | ASX – Appendix 4C | |

| 23-30 Jul | News Communiqué IV | |

| 25-31 Jul | Webinar: Strategic Update III | |

| 20-31 Aug | Financials | Pending sign-off and ratification by Auditors and Board |

| 20-31 Aug | Financial Year End 2021 | |

| 20-31 Aug | ASX – Appendix 4E | |

| 31 Aug-3 Sep | Webinar: Operations Update II | |

| 01-Sep | Goldman Sachs European Medtech & Healthcare Conference | CUV presenting/attending* |

| 23-30 Sep | News Communiqué V | |

| Oct (TBC) | Morgans Scone Annual Value in the Vines Investor Conference | CUV presenting* |

| 1-7 Oct | Notice of Meeting | To be announced and sent out electronically. |

| 1-7 Oct | AGM 2021 | |

| 24-31 Oct | Quarterly Cash Flow Statement | |

| 24-31 Oct | ASX – Appendix 4C | |

| 01-Nov | Webinar: Strategic Update IV | |

| 10-20 Nov | AGM 2021 | Planned in person meeting depending on COVID guidance.* |

| 23-30 Nov | News Communiqué VI |

Notwithstanding that the Company has not been obliged to provide periodic financial updates, as a continuum we will publish quarterly financial cash flow statements. Receipts typically will show fluctuation due to the characteristic seasonal distribution of SCENESSE® (afamelanotide 16mg) in the European Economic Area and United States, coupled with the lag in national or regional payment cycles.

US-EU-AU Distribution

In the US, our team has reached the off-beat number of 34 trained and accredited erythropoietic protoporphyria (EPP) Specialty Centers. All Centers have been individually selected while the SCENESSE® distribution program is being discussed continuously with the FDA.

With over 60 US insurers agreeing to cover the SCENESSE® treatment, the US team has already surpassed our internal target for 2021.

Treatment access from here onwards is primarily dictated by the sign off on ‘Prior Authorization’ while contractual agreement between insurers and physicians on treatment codes (i.e. reimbursement to US doctors) remains mandatory.

In Q4 2020, a landmark event has been the approval of code J7352 for SCENESSE® as “Afamelanotide implant, per 1 mg dose” granted by the Healthcare Common Procedure Coding System (HCPCS). With the introduction of this unique code, we have been shorn of the generic code J3490 which pertains to various other treatments and does not do justice to the novel afamelanotide hormonal treatment in porphyria. With the introduction of a maiden therapy for an untreated disease, our US team set out to battle for the introduction of a new J-code specific to the SCENESSE® treatment in EPP.

The HCPCS codes provide a standardised coding system for describing specific items and services, and codes are primarily used for billing and identifying items and services. Our team took it upon themselves in 2020 to secure the first treatment code for a systemic photoprotective treatment approved in the US, a reimbursement precedent which had not been achieved yet. This code should, in practice, accelerate access to treatment as insurers now have a standardised way of recognising the hormonal treatment; we shall monitor the response time by each insurer during 2021.

| US Distribution Coding SCENESSE® | ||||

|---|---|---|---|---|

| 2020 CYE | Q1 | Q2 | Q3 | Q4 |

| ICD-10 | N/A | N/A | E80.0 | E80.0 |

| CPT Code | N/A | N/A | Generic code: J3490 | Specific Code: J7352 |

| SWP/AWP | N/A | Uniform | Uniform | Uniform |

The past 12 months, I have witnessed how our teams had to hack their way through a rigid US insurance system which resisted the introduction of a treatment-unique billing code, but I salute both the US and Australian team who have come this far.

The commercial status quo on 1 January 2021 is that SCENESSE® is now listed at a uniform price across all US states, with a designated J-code. The new coding is, in itself, quite different from common practice as pharmaceutical manufacturers charge varying prices for one drug across US states, depending on diverse coding and subsequent reimbursement to physicians. CLINUVEL opted to treat all states and insurance groups fairly by maintaining one centrally registered price and by accommodating all physicians.

We also encountered questions about the ICD-10-CM. The ICD-10-CM contains codes for diseases, signs and symptoms, abnormal findings, complaints, social circumstances, and external causes of injury or diseases. The E80.0 code belongs to the category of metabolic disorders, applicable to erythropoietic protoporphyria and congenital erythropoietic porphyria.

The Current Procedural Terminology (CPT) code set is used to report procedures and services to federal and private payers for reimbursement of rendered healthcare. The next step is for our team to formally request revision of the CPT code by mid-February to reflect the specific application to SCENESSE®.

As stated in News Communiqués IV-V-VI, we had planned to distribute afamelanotide to 20 US Centers by the end of 2020, a maximum of 30 by year end 2021. Contrary to expectations, and amidst a COVID environment, our US team has performed optimally by activating 34 centres within eight months of entering the US market and in discussions with the FDA. I am confident that increased access to treatment for porphyria patients is now in place. On the regulatory front, CLINUVEL is obtaining further wholesale and distribution licenses in each US state which, in itself, will provide us new commercial opportunities for future products. The overall aim is to build a US infrastructure allowing CLINUVEL to distribute other pharmaceutical and medical products independently across US states. The manhours and pain of obtaining parallel licenses state by state is borne against the knowledge of future gains.

The distribution of SCENESSE® in the European Economic Area has been robust during 2020, and the next 12 months of commercialisation will depend on the mobility of patients which, in turn, will hinge on the rate of vaccination as well as the capacity of EPP Expert Centres to provide continuous care to EPP patients. New European countries are foreseen to allow distribution of SCENESSE®, while governments have generally called for hospitals to increase their usual clinical care in comparison to 2020.

Equally, we are pleased with the quality and pharmacovigilance team who work closely with our Qualified Person for Pharmacovigilance in monitoring, overseeing and reporting the adverse events (“side effects”) and safety profile to the regulatory authorities. While closely monitoring, we are not seeing new side effects to afamelanotide and the safety profile of the drug is constant. However, one prepares a company, our staff, and systems, for that one unexpected event which requires immediate action and investigation. Vigilance is not only required to our lead drug but mostly from how we manage all processes, requiring an everlasting assertiveness.

The feedback from European Expert Centres has been as good as we could have hoped for and our distribution team is well across the critical issues.

In Q4 2020, a landmark event has been the approval of code J7352 for SCENESSE®

The commercial status quo on 1 January 2021 is that SCENESSE® is now listed at a uniform price across all US states, with a designated J-code

| US Distribution SCENESSE® | ||||

|---|---|---|---|---|

| 2020 CYE | Q1 | Q2 | Q3 | Q4 |

| US Centers | 0 | 4 | 22 | 34 |

| US Insurers | 0 | >30 | >40 | 60 |

DNA Regeneration Program

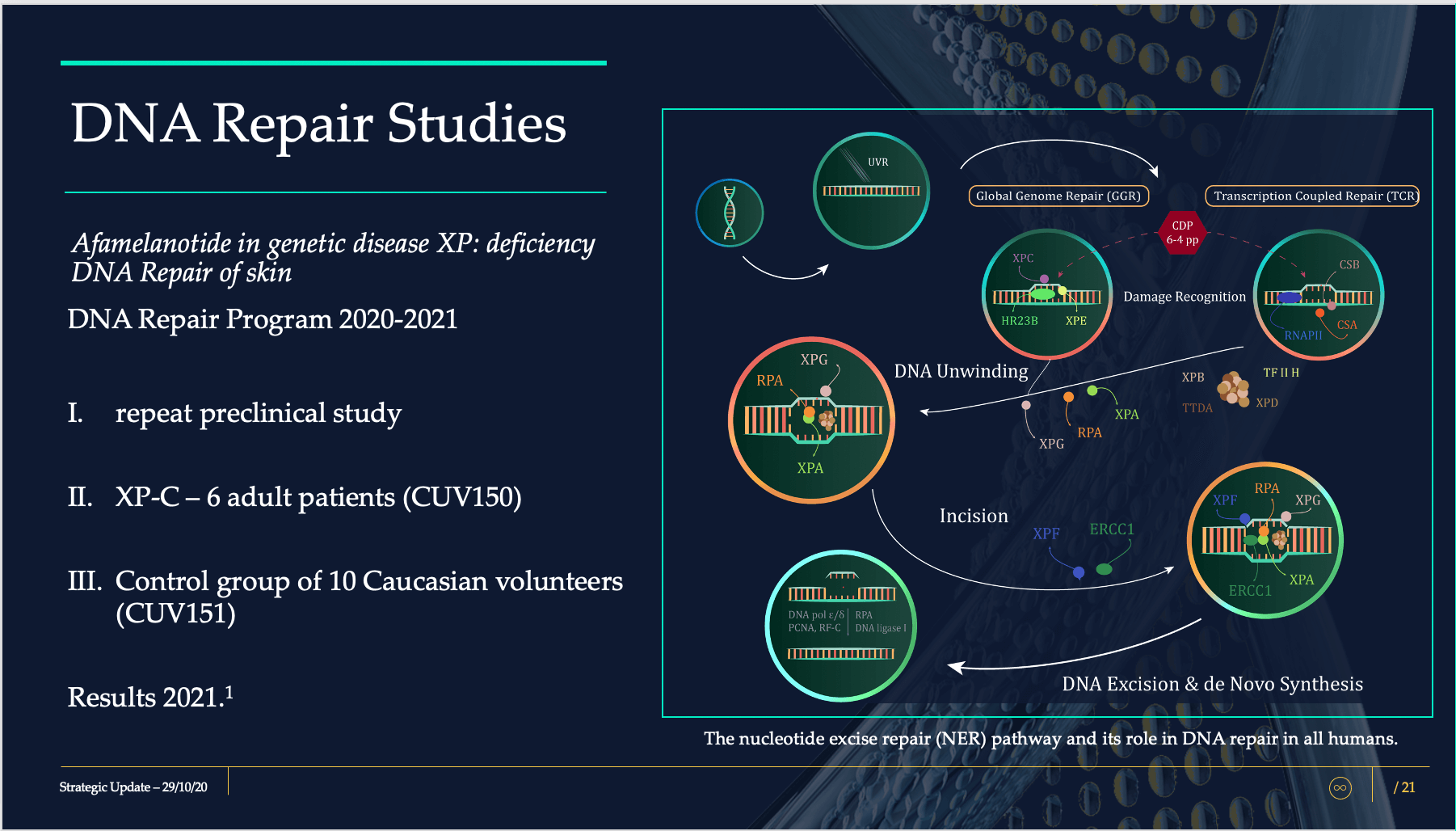

As part of the Targeted Technology Translation explained in Strategic Update I, we are analysing the DNA reparative properties of melanocortins in man. Given the importance of this program, we will provide updates throughout the year via ASX releases, Scientific Communiqués, and social and general media.

The emphasis of this program is on the nature and extent of ultraviolet (UV) induced damage, repair mechanisms and specific activity by which afamelanotide and melanocortins act on cellular damage.

The DNA Repair Program consists of CUV150 and CUV151, where UV-induced skin damage will be evaluated following administration of SCENESSE®.

The CUV150 study will comprise of six patients diagnosed with xeroderma pigmentosum complementation group C (XPC), who will receive afamelanotide.

The CUV151 study will consist of 10 healthy individuals who will be irradiated with UV to assess the skin damage provoked by UV and the repair mechanisms assisted by afamelanotide.

Pivotal in both studies are dermal biopsies, human specimens of skin, analysed for various factors and proteins affecting cellular damage repair. Both studies are innovative in that only a few research groups have ever attempted to assess and analyse the repair mechanisms following UV insult in human subjects.

Parallel to human studies CUV150 and CUV151, we are conducting pre-clinical studies as an expected confirmatory dataset to demonstrate the effects and magnitude of melanocortins on DNA damage repair. These data will be made available in the course of 2021 once these studies are statistically evaluated.

The package of CUV150 and CUV151, together with preclinical confirmatory data, will provide regulatory authorities with the strongest indication yet as to the utility of melanocortins as repair agents in skin damaged by UV and light exposure.

Since October 2020, questions have been received on the relevance of the DNA Repair Program overall, and how this would be translated commercially.

A few words on this. Single-strand DNA damage is a well-known phenomenon occurring in all of us following UV exposure. In certain populations, DNA damage is best avoided as the risk of skin cancers is exponentially increased. Most of us recover well from excessive sun damage and sunburns, however individuals with the Red Hair Colour (RHC) phenotype – Anglo-Saxons of fair skin – and with poor skin pigmentation are known to have a less efficient repair mechanism, with the risk that mutations are perpetuated and initiate cancer development. CLINUVEL’s task is to demonstrate that melanocortins are clinically protecting and improving repair mechanisms – nucleotide excision repair (NER) – in patients and individuals at high risk of UV-induced skin mutations. The commercial opportunity is arguably large and applicability of protective products relevant to a general population.

With the DNA Repair Program in humans, CLINUVEL is currently fronting the scientific community. More information will follow at regular intervals this calendar year.

We are analysing the DNA reparative properties in melanocortins in man

Single-strand DNA damage is a well-known phenomenon occurring in all of us following UV exposure

Stroke Program

On 19 January we received the ethics committee approval for CUV801, our first stroke study in patients affected by ischaemic blockage of a brain artery. We cannot bypass the work done by Dr Bilbao and Mrs Walker and team, as they succeeded in presenting compelling scientific arguments to the use of afamelanotide as an anticipated safe and effective therapy in stroke patients.

CLINUVEL’s target is to analyse stroke patients who have suffered an arterial clot at higher levels of the brain (from M2 occlusion onwards). In this category of hemi-paretic patients (loss of one-sided muscular function) there is unfortunately no effective therapy.

In our regular updates on arterial ischaemic stroke (AIS), we will discuss the study objectives and how we measure potential effect of melanocortins in the clinical setting.

Our first goal will be to monitor AIS patients around the clock to first observe that afamelanotide does not aggravate the condition or causes further cerebral loss of function. This has been the major discussion point internally, and with experts, weighing up benefits against potential risks in patients who have just suffered a stroke. In introducing a novel therapy the Company aims to administer a safe drug acting centrally.

In making afamelanotide available to stroke patients, the expectations are that afamelanotide will prove to be neurotrophic and neuroprotective, two important concepts which we will deepen throughout the year.

As CUV801 progresses we will receive more information during treatment intervals. As stated, our attention to, and management of, safety is the main pivot of the Company, the all-determining factor of long-term success.

CLINUVEL’s stroke program focuses on ischaemic stroke, responsible for 85-87% of all stroke cases, which arise from physical obstruction of blood vessels. For an in-depth look at the vascular system, see Scientific Communique VII

PRÉNUMBRA®

In last year’s News Communiqué IV, we shared how we aim to establish a distinction in formulations providing different dosing and drug availability.

Currently, the PRÉNUMBRA® formulation is progressing with a view to treating different diseases beyond EPP. We aim to use a liquid pharmacological product while shortening the length of clinical trials. The regulatory approach is based on:

a. the toxicology and safety from the use of afamelanotide; and

b. existing clinical data from the SCENESSE® implant

counting towards the building of a regulatory dossier (marketing dossier) for

PRÉNUMBRA®.

As relevant data are being released this year, we will report on the regulatory status of the second formulation.

| Differences in Afamelanotide Formulations | ||

|---|---|---|

| SCENESSE® | PRÉNUMBRA® | |

| Key pharmaceutical ingredient | Afamelanotide | Afamelanotide |

| Polymers | Yes | Yes |

| Injectable | Yes | Yes |

| Route of administration | Subcutaneous | Subcutaneous |

| Dissolvable | Yes | Yes |

| Removable | Yes | No |

| Dosing | Fixed | Flexible |

| Patients | Adults | Adults |

| Administration | By a physician | By a physician |

| Self-injectable | No | No |

| Category | Chronic, EPP | Acute, life threatening |

| Toxicology known | Yes | Yes |

Human Resources

It is demanded of us that we oversee a team of diverse talent who execute on near-term and longer visionary and realistic objectives. In many ways we see recruitment as a continuum to find the right individual for the position vacant; many of our managers interview candidates all year round to have reference points.

As the COVID pandemic unfolded, CLINUVEL actually enlarged its workforce with an eye to the future.

Across the Group, we select on criteria such as education and academic background, experience, attitude, values and last, but not unimportantly, corporate fit. Specifically, our executive team is tasked to spend management time to develop young or newly recruited professionals.

I see much value in building out this ensemble of professionals, as they become better at, and passionate about, what they do. The intrinsic value of the Company is encapsulated largely by its staff.

In this vein, the staff have annual objectives in the form of Key Performance Indicators aligned with the overall Group’s goals.

The frequent feedback we receive is that CUV offers a unique environment where people are able to accumulate experience in a safe setting, and where people actually care about the job and each other. It is an evolving company with plenty of talent.

From a bird’s eye view, there are very few domains where I express contentment but when it comes to the coherence of our workforce, I see up close how the calibre of professionals is continuously increasing, witnessed by the quality of interchange and decisions taken.

Recruiting the right professionals is a process which never reaches completion, nevertheless I am pleased with the mix of professionals we have been able to recruit and talent we can keep. Henceforth, our task in the coming year is to ensure rapid integration while spending time on periodic evaluation guiding new personnel towards our joint objectives.

In terms of governance, we track ahead of international recommendations, with a ratio of 61%:39% female to male workforce within the Group, and a 50%:50% representation in the Board of Directors.

The intrinsic value of the Company is encapsulated largely by its staff.

Public and Investor Relations

The new year commenced on the investor relations front with a corporate presentation to the H.C. Wainwright Bioconnect Conference and our participation as a delegate to the J.P. Morgan Healthcare Conference.

H.C. Wainwright Bioconnect was an early opportunity to gauge how well CLINUVEL is positioned to diversify and grow. The Company’s presentation was one of 375 delivered to the conference which attracted more than 450 investors. More than 20,000 views were tracked for the company presentations and panel discussions throughout the conference week. Positive feedback was received on the content and professionalism of the presentation which covered:

- the phases of CLINUVEL’s evolution;

- the role of melanocortins in the body and the wider application of afamelanotide and its derivatives to different indications; and

- the reorganisation of the Group to focus on three Divisions, supported by the Research, Development, and Innovation Centre in Singapore.

A key outcome of the J.P. Morgan Healthcare Conference (held virtually for the first time) was the considered optimism of the larger pharmaceutical firms that presented. Executives expressed confidence in the economic outlook due to both expected control of the coronavirus pandemic, and their own suite of products and research and development pipelines. Specifically, on the outlook for the United States, the Chairman and CEO of Merck and J.P. Morgan, Kenneth Frazier and Jamie Dimon, respectively expressed confidence in a positive future, placing the key focus on the need to reduce the disparities that exist in health, education, and employment opportunities.

Later this January, CLINUVEL will announce the December quarter 2020 cash receipts which we understand is of shareholder interest. This will be followed at the end of February by the financial report for the half year to December 2020. These key indicators will provide a timely update on the progress of commercial operations. These will also reflect the expenses being incurred to diversify the business with new indications and healthcare products for wider non-pharmaceutical use. More announcements are planned as the Company’s research and development program progresses.

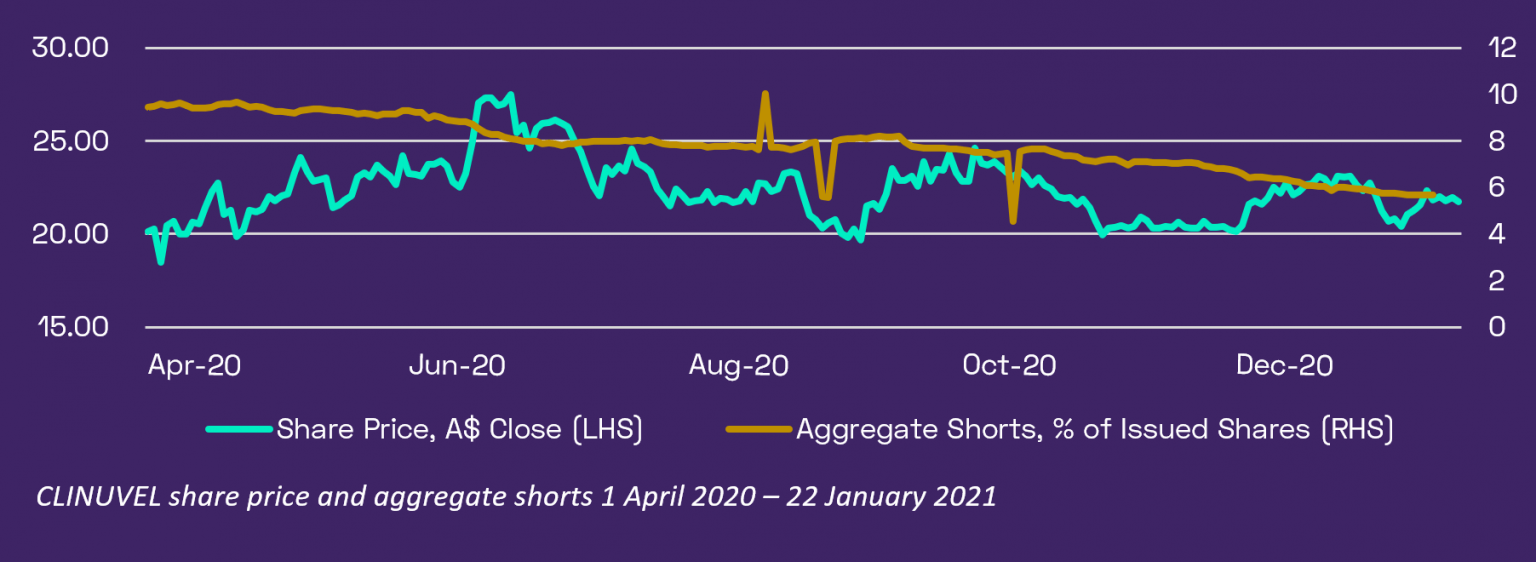

Shorting activity of CUV has abated from a peak of 9.65% in April 2020 to 5.69% as of latest information on 21 January 2021. The welcome exit of shorters means the number of shorted shares has reduced from 4.8 million to 2.8 million over this period. Over the last three months as shorters have been progressively exiting CUV, the share price has ranged between A$19.92 and A$23.56, indicating positive underlying support for the stock.

H.C. Wainwright Bioconnect was an early opportunity to gauge how well CLINUVEL is positioned to diversify and grow.

Analyst coverage continued with Moelis Asset Management (Sarah Mann) and was initiated by Jefferies Australia (Dr David Stanton). The Company’s analyses illustrate how both seem to be well across CUV’s direction. Since CLINUVEL is not allowed to distribute the analyst reports directly to shareholders, one is kindly referred to both investment advisories to pay for and obtain the analyst reports.

Conclusion

As published in the Strategic Update I, the main pillars of our business approach are to:

I build countercyclical buffers to economic downturns,

II minimise equity dilution,

III maintain profitability,

IV manage costs,

V retain and attract talent,

VI expand the Group, and

VIII vertically integrate business functions.

Many of CLINUVEL’s activities take place behind curtains and aim to leave behind a

foundation for growth for the next set of managers and to keep competitors at

bay.

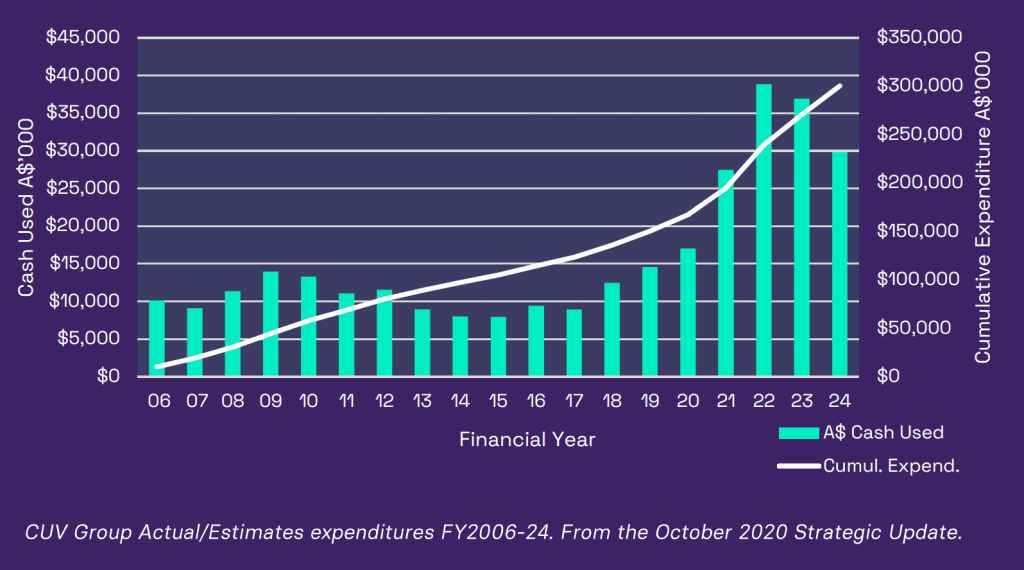

Our prospective expansion is represented graphically below, highlighting the planned cumulative expenditures over the next three year

In 2021, we

plan for a more aggressive investment approach to our balance sheet management,

more opportunities for growth of the Group, and preparation of several clinical

and non-clinical asset launches.

Central to

our business execution is risk management in varying domains, paying attention

to all foreseeable risks in an attempt to influence or control these where

possible.

The CUV

Group now operates under three cross-functional divisions: Pharmaceutical,

Healthcare Solutions and Communications-Branding-Marketing. With a mutual

thread of objectives among staff, we have created a global corporate

connectivity operating in harmony. Continuity is key and with many of our

personnel being retained in the Company for more than five years, we operate a

lower turnover relative to our peers.

In 2021 we

strive and expect to outshine previous years as we build out the group of

companies. We are all aware that we have 240 days to achieve our goals in

confined mode, but most of us realise that we need to put in far more than the

statutory hours per week to get the job(s) done. Unsurprisingly, professional

commitment across the companies is high.

A number of

publishers and business authors had approached us the past years to write a

book on the CLINUVEL story, and in 2018 we had reached an agreement with

Columbia Business School (CBS) to publish the corporate story, on the condition

that FDA approval for SCENESSE® would actually be obtained. With

in-depth interviews of all relevant directors, management, direct investors and

researchers, a business case is being completed for next generations to build

on and students to analyse.

My own

reservation has always been not to publish too soon, since there are many

pharmaceutical successes which could equally be written up. But, given the

persistent interest, we finally agreed having succeeded in the regulatory

approval in the US on 8 October 2019. Therefore, in 2021, in cooperation with

CBS (NYC), we intend to publish a book releasing factual information on the

evolution of afamelanotide and CLINUVEL as a serial documentation of decisions

taken to date.

When

zeroing in on the ownership of CLINUVEL, in December we saw an unusually high

increase of 500 shareholders who purchased our stock. Over 2020, we have

witnessed an absolute increase of 1,540 registered shareholders across the

three regions, Europe, Asia-Pacific and the United States.

I leave you

with the notion that, against the gloom of the ongoing pandemic, our teams

remain calm and confident, and embrace new opportunities opening up. As

companies in large numbers take on debt and commit to equity facilities, we use

our skills to come through the heavy economic weather unscathed, with a clean

balance sheet and a rich pipeline.

Oozing with

energy, staff and Board have started 2021 with ambitious but realistic

objectives to realise perennial value.

Philippe Wolgen

H.C. Wainwright Bioconnect was an early opportunity to gauge how well CLINUVEL is positioned to diversify and grow.

Share Price

Authorised for ASX release by the Board of Directors of CLINUVEL PHARMACEUTICALS LTD.

Forward-Looking Statements

This release contains forward-looking statements, which reflect the current beliefs and expectations of CLINUVEL’s management. Statements may involve a number of known and unknown risks that could cause our future results, performance, or achievements to differ significantly from those expressed or implied by such forward-looking statements. Important factors that could cause or contribute to such differences include risks relating to: our ability to develop and commercialise pharmaceutical products, the COVID-19 pandemic affecting the supply chain for a protracted period of time, including our ability to develop, manufacture, market and sell biopharmaceutical products; competition for our products, especially SCENESSE® (afamelanotide 16mg); our ability to achieve expected safety and efficacy results through our innovative R&D efforts; the effectiveness of our patents and other protections for innovative products, particularly in view of national and regional variations in patent laws; our potential exposure to product liability claims to the extent not covered by insurance; increased government scrutiny in either Australia, the U.S., Europe, China and Japan of our agreements with third parties and suppliers; our exposure to currency fluctuations and restrictions as well as credit risks; the effects of reforms in healthcare regulation and pharmaceutical pricing and reimbursement; that the Company may incur unexpected delays in the outsourced manufacturing of SCENESSE® which may lead to it being unable to supply its commercial markets and/or clinical trial programs; any failures to comply with any government payment system (i.e. Medicare) reporting and payment obligations; uncertainties surrounding the legislative and regulatory pathways for the registration and approval of biotechnology based products; decisions by regulatory authorities regarding approval of our products as well as their decisions regarding label claims; any failure to retain or attract key personnel and managerial talent; the impact of broader change within the pharmaceutical industry and related industries; potential changes to tax liabilities or legislation; environmental risks; and other factors that have been discussed in our 2020 Annual Report. Forward-looking statements speak only as of the date on which they are made, and the Company undertakes no obligation, outside of those required under applicable laws or relevant listing rules of the Australian Securities Exchange, to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. More information on the forecasts and estimates is available on request. Past performance is not an indicator of future performance.